07 Oct 2021 Jane Whitmoore

Terra (LUNA) Spikes To An All-Time High After A Protocol Update

Protocol upgrades have proven to be a big reason for the exponential growth of crypto projects. Bitcoin’s halving events, for example, have proved that in the months following such an event, Bitcoin’s price steadily increases. Ethereum also experienced such price actions, when the development team announced the ETH 2.0 staking contract was live.

Now, yet another project experienced massive price gains, which eventually resulted in an all-time high - Terra (LUNA). The much-anticipated Columbus-5 update went live on Terra’s mainnet on September 30, skyrocketing its price from $33,66 to an all-time high of $49.45 just four days later. Currently, LUNA trades for $46.17.

One of the biggest changes Terra introduced with the Columbus-5 network update is a modification to the project’s tokenomic model. Now, all LUNA tokens, used to mint the Terra (UST) fiat-pegged stablecoin, are going into a dead burning address, instead of inflowing into the community pool. According to Terra, a total of $832 million worth of LUNA tokens were burned successfully in Columbus-5’s genesis block.

The burning mechanism of Terra closely resembles Ethereum’s gas fee burning algorithm, introduced with EIP-1559, which leads to deflationary pressure to the token supply and it could help boost its price in the long term as demand for UST grows.

Furthermore, Columbus-5 also adds IBC standard compliance, which opens Terra to the Cosmos ecosystem and an increase in DeFi applications and TVL on the protocol. The Inter-Blockchain Communication (IBC) standard allows Terra to communicate with all other projects in the Cosmos ecosystem, effectively increasing adoption throughout the Cosmos ecosystem and make UST the stablecoin of choice for applications and chains in the network.

The UST exposure could also lead to an increased supply deflation of LUNA since more LUNA would have to be burned in order to mint new UST stablecoin.

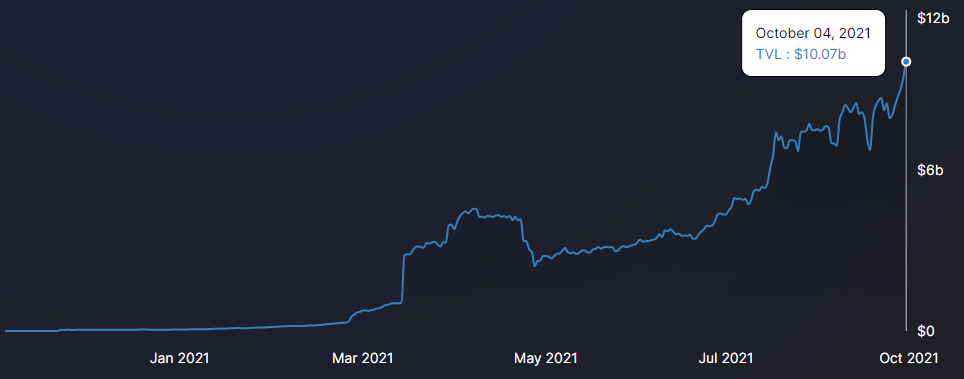

LUNA’s increasingly bullish attitude may have been also due to Terra being the base for its growing ecosystem of decentralized finance (DeFi) protocols, pushing the total value locked to a new all-time high.

According to DeFiLlama, the TVL on the Terra network surpassed $10,000,000,000 and clocked in at $10,07 billion before dropping to a current value of $9.51 billion.

Source: DeFiLlama

Source: DeFiLlama

Ethereum is still the preferred DeFi blockchain with a total value locked level of $141.71 billion, followed by Binance Smart Chain with $18.43 billion.

Altcoin News crypto token altcoin cryptocurrency news crypto news Crypto Price