13 Mar 2020 Morgan Hayze

BitМex Accused of Slashing Bitcoin Price To $3,700

Bitcoin has recorded one of its most significant downfalls since the 2017 crypto bubble burst, losing over 40% of its value in a matter of two days.

Bitcoin's price made several severe price swings, with crypto enthusiasts like Jacob Canfield pointing out that the price per Bitcoin on Bitmex went down to $3,600 before swinging up to $4,400 and re-plummeting to $3,600.

"15 minutes after the swings BitMEX shut down its login, which caused the massive swings and high selling pressure", crypto traded Salsatekila tweeted. "Spot traders were on the lookout for a massive buy-in amid the panic," Salsatekila added.

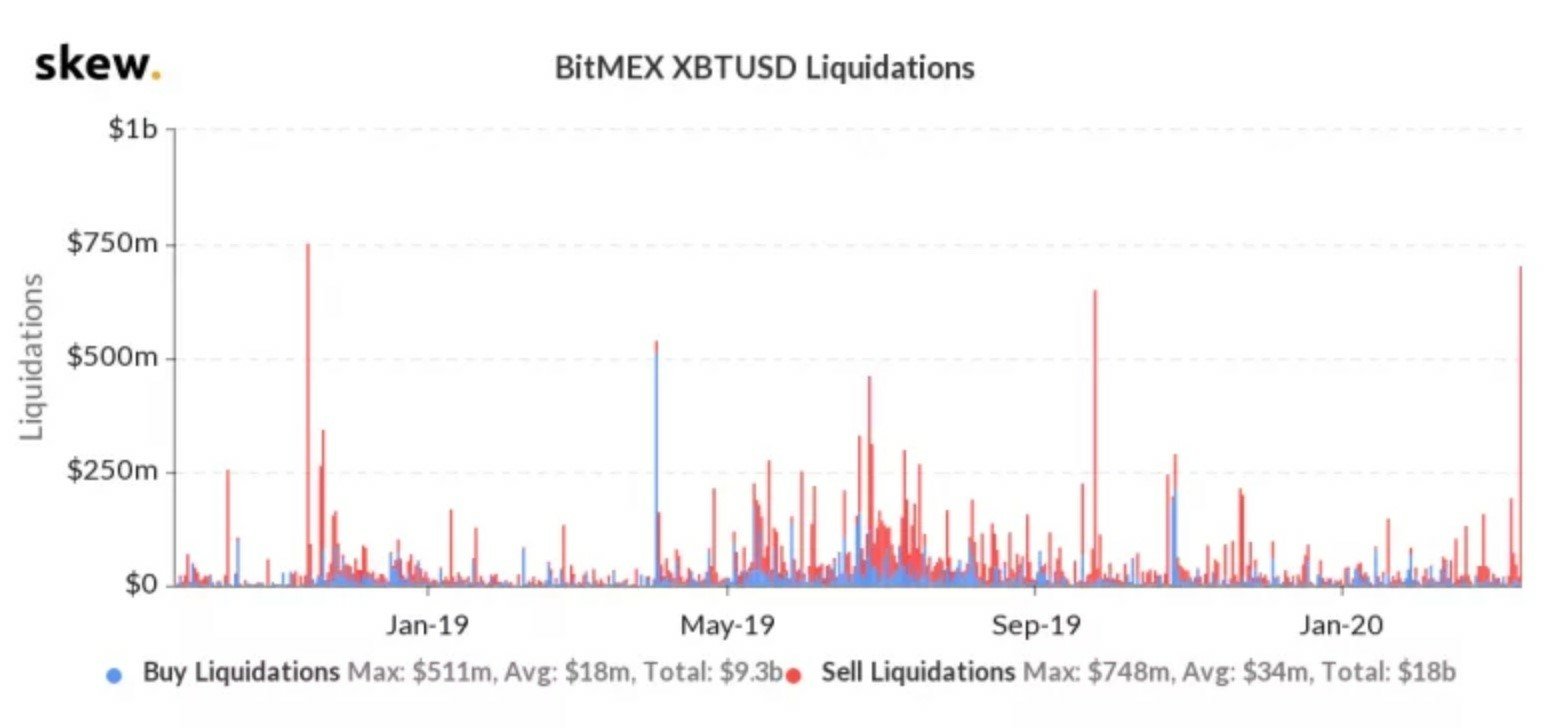

The rumors about BitMEX foul playing, as Bitcoin's price fell as low as $3,700, were further intensified with the exchange reporting about "hardware issues." BitMEX went "off the grid" for 25 minutes, citing "hardware problems with the cloud services, resulting in delays and seized operations of the exchange." The events occurred between 02:16 and 02:40 UTC on March 13, amid long position liquidation and sell-off frenzy.

While the crypto sector enters a rollercoaster price ride, some crypto enthusiasts even put the blame on BitMEX for Bitcoin's price turmoil. Crypto research CEO Sam Bankman-Fried accused BitMEX of having "no real hardware issue." Bankman-Fried continued with his accusations towards BitMEX, stating that the unwillingness of the exchange to address the current market situation promoted Bitcoin's price fall, which took the entire crypto sector with it.

"When BitMEX was offline, Bitcoin's price made a quick recovery, which is a sign that BitMEX acted as a huge sell-off barrier due to Bitcoin's long position liquidation. Even further, higher Bitcoin prices would result in fewer position liquidations," Bankman-Fried concluded.

BitMEX responded to Bankman-Fried's accusations by claiming his words to be nothing more than a conspiracy theory.

However, the crypto sector still seeks the primary reason for the 40% drop of almost all cryptocurrencies. Some experts believe that traditional investment assets such as the S&P 500 and DOW indexes are putting pressure on the crypto sector, which lost ground and tumbled. Other experts are thinking the widespread panic for the new coronavirus pandemic is causing markets to shrink.

Crypto traders, at least in the past 48 hours, are seeking liquidity for the crypto assets they hold, as the ratio between sellers and buyers has shifted strongly towards the sellers. As of press time, Bitcoin still acts like a risk-on asset, throwing out recent theories of providing a safe haven for investment in times of crisis. Nevertheless, traditional haven assets, like Gold, also suffered from the market crash, with AUX retracting 2% since the start of the Coronavirus outbreak.

Bitcoin Cryptocurrency exchange Cryptocurrency Regulations Cryptocurrency Crypto Market Exchanges News crypto Bitcoin price cryptocurrencies exchange bitcoin news cryptocurrency news crypto news bitcoin news today Exchanges BitMEX Coronavirus