01 Mar 2021 Simon Briggs

Changes In Cryptocurrency Reporting Requirements For The US Taxpayers

The crypto industry’s development over the past several years made a huge impact on the way how users interact with money. However, regulators like FinCen and the Department of Treasury lagged behind in terms of proper tax payment for virtual assets like Bitcoin.

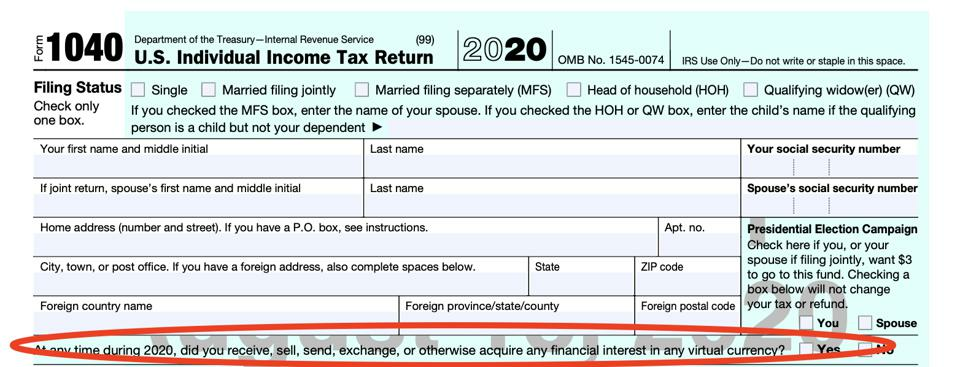

Things are about to change for crypto holders as the 2020 IRS Form 1040 for Individual Income Tax Return now includes a line whether or not in the past year taxpayers bought, sold, or exchanged virtual currencies.

It seems that the Internal Revenue Service (IRS) has taken on cryptos very seriously, learning its lesson from past mistakes - back in 2008 the IRS asked for information about interest in foreign bank accounts, but the placement was near the end of the tax document, which made many taxpayers not populating the form.

Source: 2020 IRS Form

This time the IRS puts the question about cryptocurrencies on the top page to eliminate the possibility of missing that part in the form. Meanwhile, on December 30, 2020, the FinCen issued Notice 2020-2, which further adds to the reporting requirements by outlining that virtual currencies should be added into the Foreign Bank and Financial Accounts (FBAR).

“FinCEN intends to propose to amend the regulations implementing the Bank Secrecy Act (BSA) regarding reports of foreign financial accounts (FBAR) to include virtual currency as a type of reportable account under 31 CFR 1010.350,” the notice reads.

However, the current FBAR format must be changed as currently the FBAR does not consider virtual currencies. However, FBAR obliges taxpayers to report “balance in the account during the year and then convert to Treasury's Financial Management Service rate the last day of the calendar year.”

Cryptocurrencies, however, are still highly volatile assets, as prices may swing both up and down immensely in just one day. Furthermore, there are several types of cryptocurrencies, which may worsen the reporting situation. FBAR must be reshaped to accommodate for such drastic price changes before pushing it into the crypto sector.

Meanwhile, the penalties for making a mistake or not filing the appropriate tax amounts can range from 20 to as much as 75% of the understatement of tax. However, not all crypto operations have taxes. The IRS putting the question about reporting cryptocurrencies, however, imposes threats on taxpayers, as they can be fined for misreported information.

Cryptocurrency Regulations cryptocurrencies cryptocurrency news us economy Regulation USA US Regulations