27 Apr 2020 Anthony Lehrman

Grayscale Holds Half Of The Mined ETH Tokens In 2020

Ethereum seems to enjoy investor attention, despite the turbulence in the crypto sector in 2020. Some crypto asset management companies even go to extremes, as Grayscale Investments bought 48,4% of all freshly-mined Ethereum tokens in 2020.

Grayscale emphasized on the increased interest from investors, most of which institutional. The company outlined that the long-awaited ETH 2.0 update could be the main driving force behind the interest from investors.

Various reports state that the total amount of mined ETH tokens from the start of 2020 is 1,563,245.875. Meanwhile, Grayscale’s Ethereum Trust (ETHE) issued 5,230,200 shares as of the end of 2019. The company currently has 13,255,400 shares, with a price point of 0.09427052 ETH per share. The calculations show that Grayscale bought as much as 756,239.777 ETH.

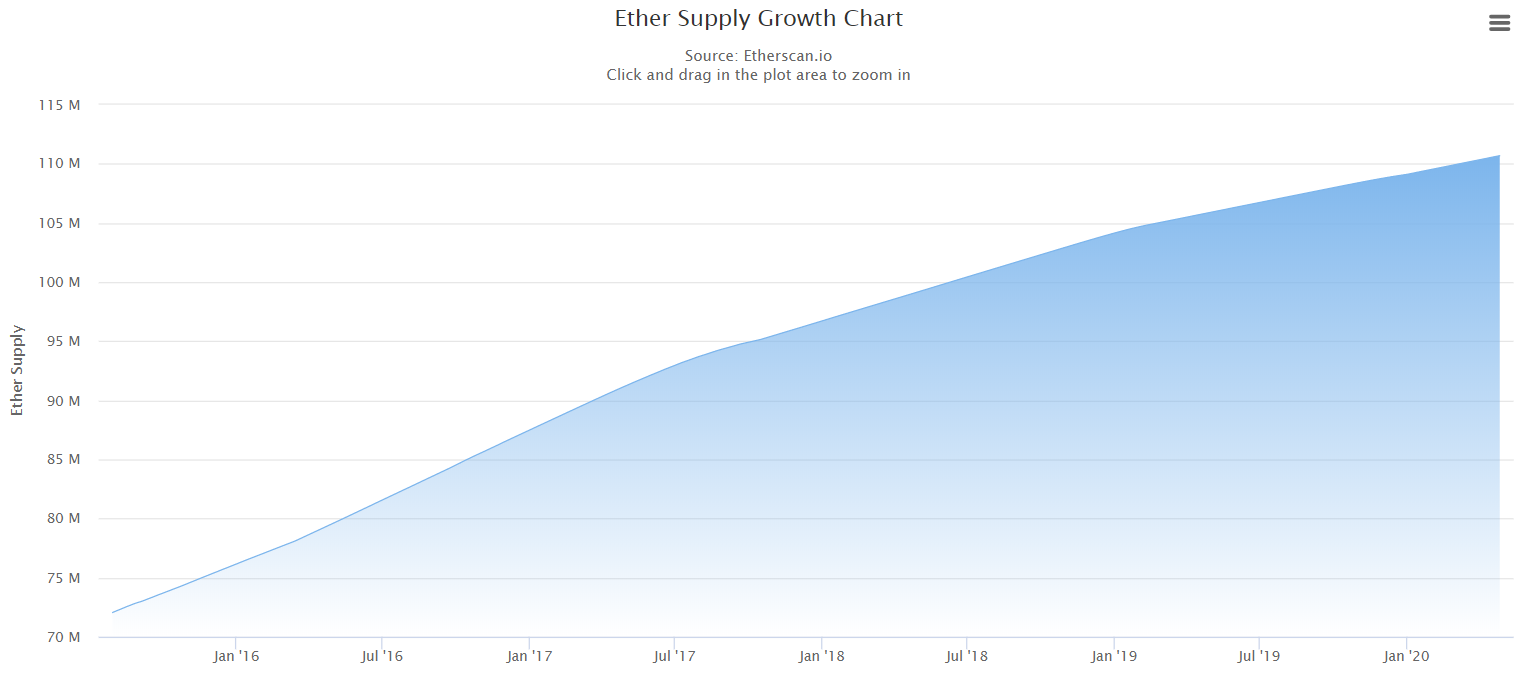

Source: Etherscan.io

Furthermore, the asset management company published its Q1 report, stating that institutional investors have increased their interest in Ethereum exponentially, despite the rough times for the crypto sector. Grayscale noted that during the first quarter of 2020, ETHE received $110 million of cash inflows, which surpasses the total amounts of cash inflow from 2018 and 2019 combined.

One of the major selling points, according to Grayscale, is the migration from proof-of-work to proof of stake consensus algorithm, which would allow Ethereum’s database to scale with greater ease.

Meanwhile, institutional investors do not seem intimidated by the 420% premium Grayscale is offering. Currently, the price per share in Grayscale’s Ethereum Trust is $92, while the real value per share is just $17,7. One of the significant reasons behind Ethereum’s increased demand, despite the hefty premium, is the fact institutional investors are free from depositing, transferring, and managing their Ethereum funds in-house.

Spot prices, however, tell a different story. From the start of 2020, Ethereum’s price gained almost 50 percent. The second-largest cryptocurrency to date started its climb from $130 to currently trade at $196.44. Ethereum had its own share of ups and downs, as the turbulence skyrocketed Ethereum to $290, before plummeting to an $87 low during the mid-March pandemic sell-off pressure, as reported by several exchanges.

In order to continue its year-to-year climb, Ethereum has to overcome the solid $198 resistance, then aim for $200 and up. The primary support zones lie at $194 and $187, respectively.

Ethereum Cryptocurrency Crypto Market mining crypto eth crypto market monitoring Ethereum news investing cryptocoins etherium invest ether