09 Sep 2020 Anthony Lehrman

The Rise Of Decentralized Exchanges May Disrupt The Financial Status Quo

Uniswap, dubbed as one of the leading decentralized exchanges, recently surpassed Coinbase Pro in daily trading volumes, reaching levels of nearly $1 billion, as of 1st September 2020.

Despite Coinbase Pro not being the largest centralized exchange, this is a clear signal that DEX exchanges are quickly catching up the well-established centralized crypto exchanges.

Uniswap is working both as a decentralized exchange and an automated liquidity protocol. Users that visit their platform are enabled to purchase and sell ERC-20-based tokens and earn exchange fees for providing liquidity.

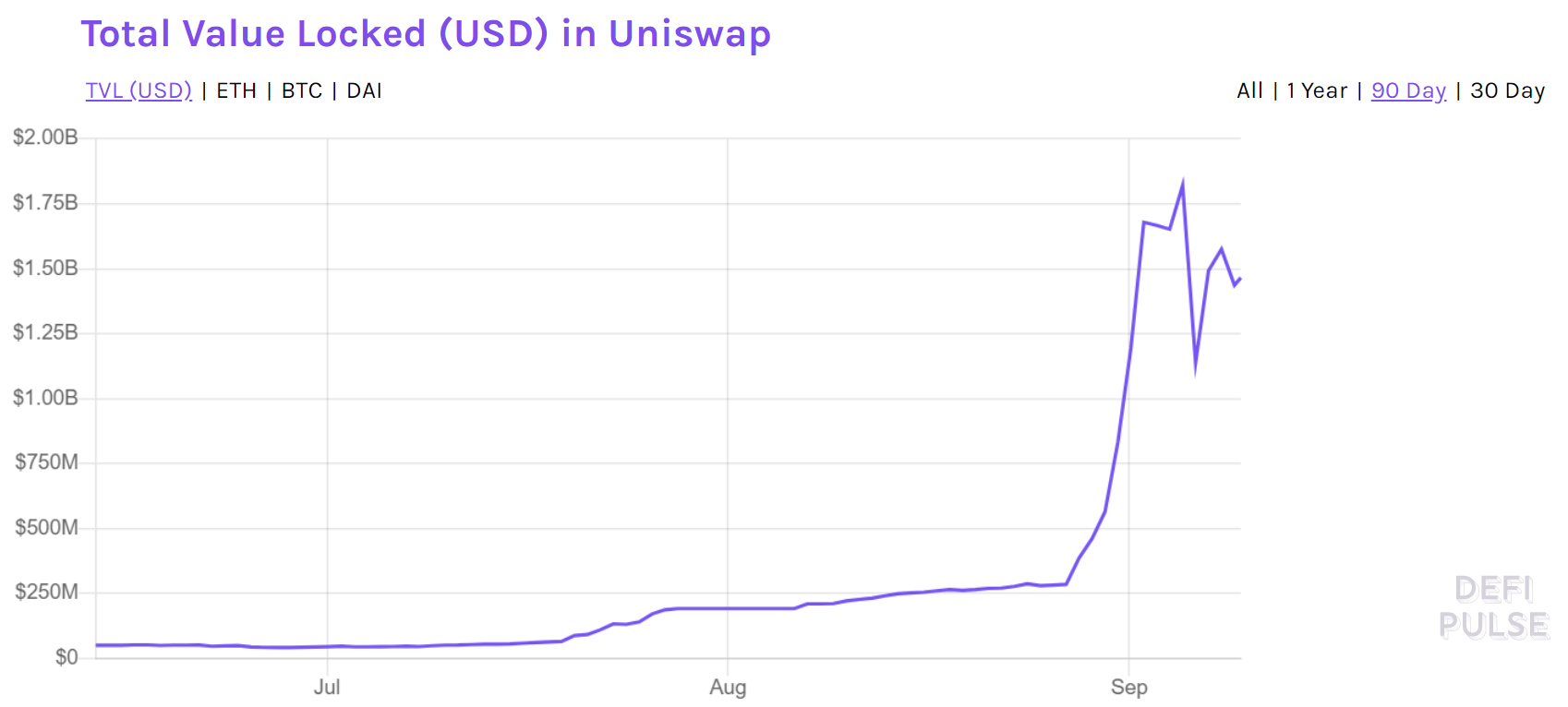

The mechanism behind Uniswap means that the bigger the trading activity, the bigger the reward for liquidity providers. This explains why Uniswap has increased both in trading volumes and popularity in recent months. The total value locked (TVL) in Uniswap reached a price point of $1.47 billion as of press time, according to data from DeFi Pulse.

Source: Defi Pulse

However, decentralized exchanges existed before the DeFi boom, but traders referred to traditional centralized exchanges for the sake of convenience. The DeFi sector quickly advanced in the technology realm, making DEX as sophisticated and easy to use as centralized exchanges.

Meanwhile, the DeFi sector saw the rise of many exchanges, with different implementations and different operating networks underneath them. Uniswap, for example, emphasizes on ERC-20 tokens, while Curve focuses on stablecoins. And despite that Uniswap and Curve have become among the most popular DeFi options, protocols like 0x and EtherDelta laid the foundations behind decentralized exchanging.

However, the rapid boom of decentralized exchanging also leads to various problems, the biggest being the lack of liquidity, despite the recent month saw a massive increase in liquidity provision. Ilya Abugov from DappRadar stated that exchanges have to maintain liquidity:

"Given the recent meme-DeFi trend, they have to become and stay relevant. At the same time with speed and marketing coming to the forefront the tech needs to not become a liability.”

Other drawbacks include unexpected jumps in transaction fees, which, given Ethereum's current network state, may present a huge bottleneck in decentralized exchange adoption. The complicated user interface also presents a major issue in the mainstream adoption of DeFi-based exchanges.

Institutional investors, on the other hand, are still hesitant to dive into the DeFi sector, despite several investors already joining the DeFi bandwagon. Lanre Ige from 21Shares mentioned that the altcoin and DeFi sectors already received some interest from institutional investors.

“It’s still very early to judge to what extent institutions will get involved in DeFi given that there currently aren’t many products that currently provide exposure to DeFi for the institutional investor. However, both BNB and Tezos ETPs are two of our most popular historically and currently which is a signal of some institutional interest in altcoins and DeFi. We think this will grow as more products, such as ETPs, are available for DeFi“, Ige stated.

The interoperability, between the traditional financial sector and DeFi, becomes a major focus for many of the companies operating in the sector. Platforms such as Synthetix are already bringing real-world assets to a decentralized setting and are becoming very popular. Other projects such as Komodo are providing decentralized exchange services between different blockchains with atomic swap technology, additionally contributing towards the financial disruption that the market is experiencing.

Ethereum Cryptocurrency exchange Crypto Market Exchanges News Financial service ERC20 Coinbase Pro trading exchange bnb finances decentralization dex decentralized Exchanges Defi Tezos Decentralized Finance Uniswap