12 Oct 2020 Jane Whitmoore

Diminishing Number Of Active Ethereum Addresses Could Decrease Gas Fees

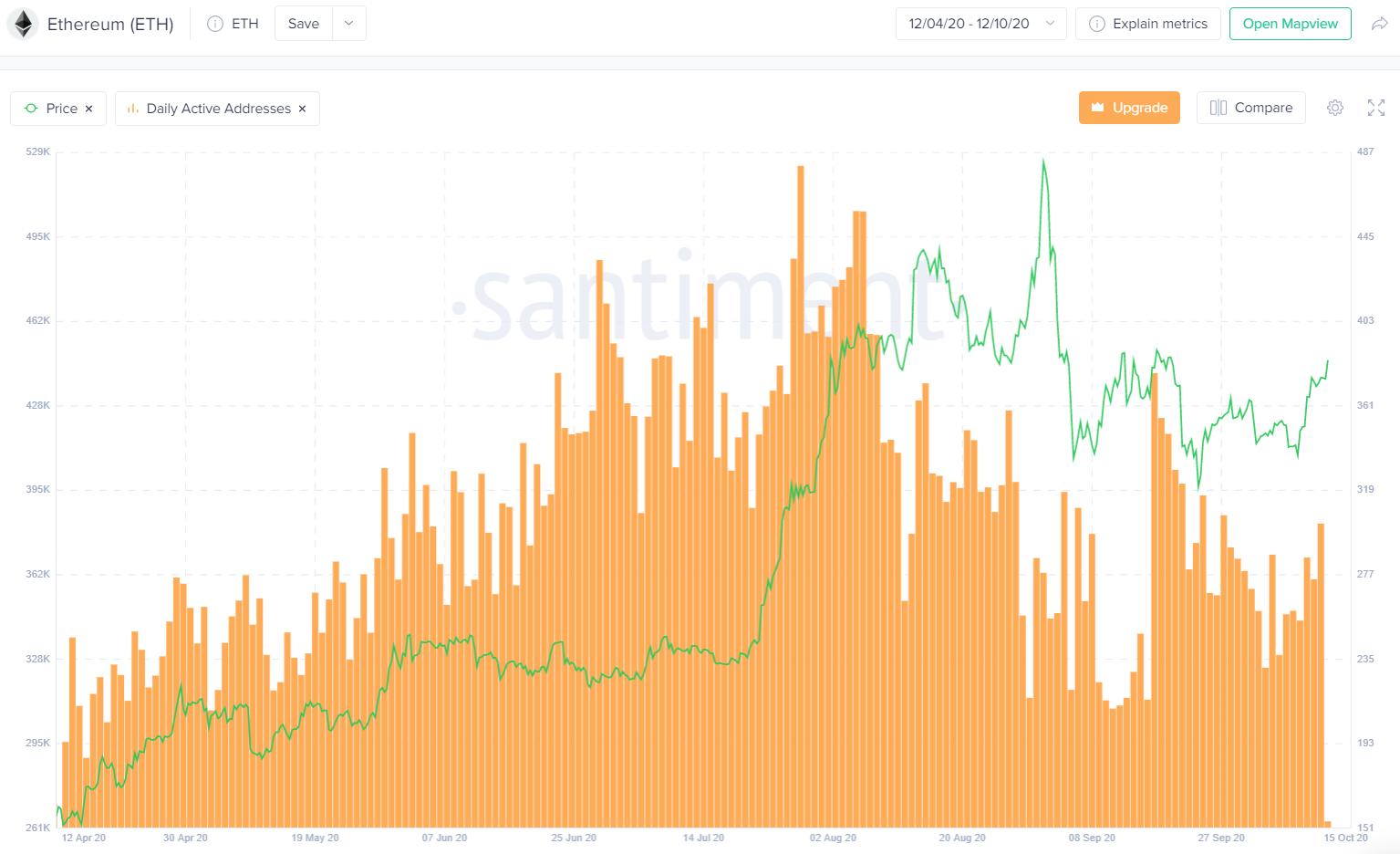

Crypto analytics platform Santiment reported that the total number of unique active wallet addresses on Ethereum’s blockchain is declining, most evident since mid-September. On the other hand, August and September marked spikes in terms of active wallets, which is induced by the recent DeFi boom and yield farming possibilities, presented mostly by Uniswap.

„ETH‘s daily active address metric is still revealing that there is still plenty to be desired since its peak in late July. There has been a decline in unique addresses interacting on the #Ethereum network, particularly since September 17th“, Santiment tweeted.

Source: Santiment

The cool-off period in the DeFi sector can be easily monitored through the decrease of active users, which in turn, lowers the network`s usage and gas prices. The total value locked remains above the $11 billion level, however, food framing frenzy and yield-related activities are declining.

Meanwhile, with the drop in both activities on ETH addresses, as well as the DeFi frenzy cool down, gas prices also took a downwards direction. According to bitinfocharts.com, the network usage fees for Ethereum plummeted 91% from its all-time high in early September. The time frame correlates with the SushiSwap massive price peak.

The second gas spike occurred on September 17, which correlates with Uniswap launching its four liquidity pools, as well as an option for mining UNI governance tokens. On some occasions transfer fees jumped over 10%, reaching as high as $50 for a transaction.

Currently, average transaction prices normalized at around $1.33, going back to the levels prior to the DeFi boom. A report from ETH Gas Station shows gas prices reaching 40 gwei for regular transactions, while high-speed transactions are priced at 50 gwei. Uniswap still takes the leadership in gas consumption with $12.7 million processed over the past 30 days.

Ethereum prices also took a bullish sentiment, with the second-largest cryptocurrency just reaching $383 level for the first time since 20th September. Data from CryptoBrowser.io also shows that Ethereum gained 12% in its price since its last week low of $337. Crypto trader Logan Han made a prediction that the short-term price of Ethereum may surpass its all-time high in 2021.

Ethereum Blockchain Cryptocurrency wallet Ethereum news cryptocurrencies cryptocurrency news decentralization ether Defi Decentralized Finance Uniswap cryptocurrency market