11 May 2020 Morgan Hayze

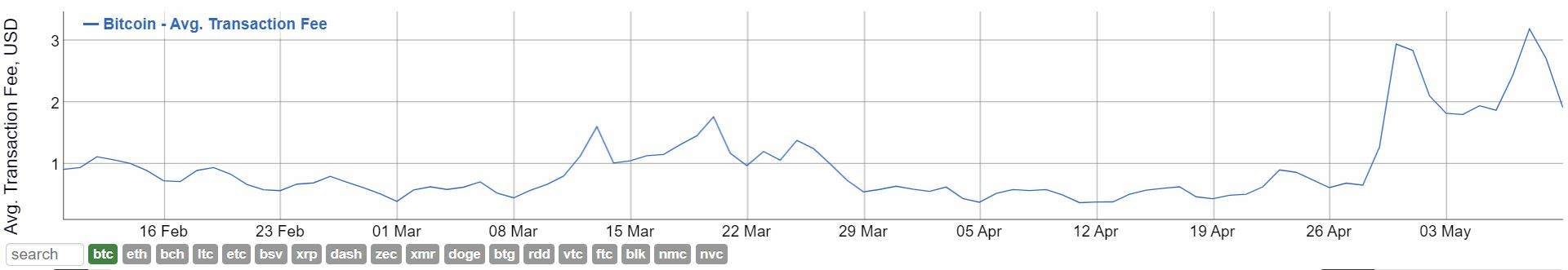

Triple Increase On BTC Transaction Fees Just Before Bitcoin`s Third Halving

The world of cryptocurrencies is franticly preparing for Bitcoin’s third halving event, which would cut down the reward that miners receive for validating transactions.

Historically, prior to a halving event, transaction fees skyrocket. The last halving resulted in peak transaction fee of $0,62, with transactions costing a mere $0,10 just weeks before.

Source: Bitinfocharts

However, the halving event means something more than just transaction fees increase. Bitcoin suffered from increased volatility over the past weekend, with prices swinging from close to $9,700 on May 10, to shrink as low as $8,466 on May 11. Nevertheless, Bitcoin’s price is still 40% up year-to-date (YTD), which implies strong support from Bitcoin bulls. The price swing outperforms serious investment assets like gold (XAU) and U.S. dollars.

Speculators expect the halving event to boost Bitcoin’s price, as the price inflation reduces when the reward for mining a Bitcoin block reduces in half. Тhe primary reason behind both Bitcoin’s price increase and inflation reduction is a term, called scarcity. Scarcity resembles how rare to obtain a given asset is. Meantime, Bitcoin’s user base is exponentially increasing. The current 1,800 BTC-per-day premium would be reduced to 900 BTC per day.

Joe Llisteri, the co-founder of crypto derivatives exchange Interdax, stated that over time, the reduction of BTC supply would ultimately lead to a reduction in sell pressure. “The factors add up to an increase in upwards momentum for Bitcoin’s price.”, Llisteri added.

Llisteri also noted that this time Bitcoin’s upwards momentum may see a slower effect, due to progressively longer life cycles for Bitcoin after a halving event. “Currently, we are looking at 18-24 months until a possible all-time high. Timewise, Bitcoin may reach an all-time high between October-November 2021 and May-June 2022.”, Llisteri concluded.

However, small and medium-sized miners may take a serious hit, as the price reward cut may mitigate all possible earnings from small mining enthusiasts and mid-sized mining rigs. Even with the much-anticipated Bitcoin price boost, much of the miners may shut down operations prior to the price increase.

Speaking of mining, Bitcoin’s hash rate continues to keep a steady growth, slightly declining from its yearly high of 123.2 terra hash-per-second (TH/s). There are two possible scenarios – either more miners are joining the Bitcoin network, or current miners are driving their existing rigs to a maximum.

Bitcoin cryptocurrency trading Cryptocurrency Crypto Market Bitcoin mining crypto market monitoring Bitcoin price bitcoins exchange price bitcoin news bitcoin news today Prices