12 Jan 2022 Morgan Hayze

Bitcoin And Stocks Are Moving In Sync, Imposing Risks, According To The IMF

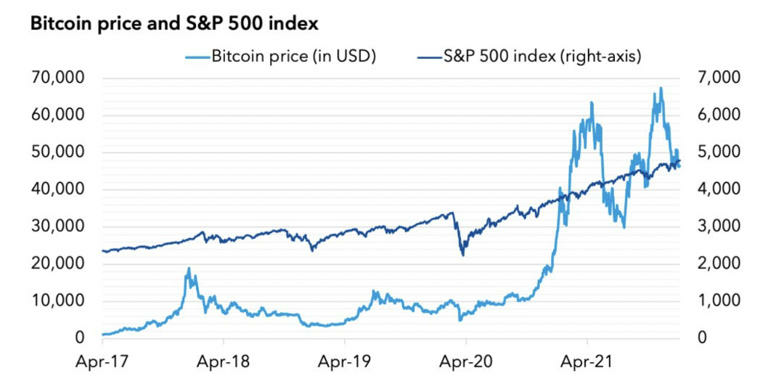

The International Monetary Fund, or IMF, highlighted in a blog post that since the COVID-19 pandemic, Bitcoin and large-cap US stocks have been moving more in tandem with each other. However, the tighter correlation imposes risks to financial stability, the IMF stressed.

Source: IMF

Source: IMF

“Our analysis suggests that crypto assets are no longer on the fringe of the financial system,” the financial institution noted, emphasizing that the Bitcoin S&P 500 correlation is greater than that between stocks and other assets such as gold, major currencies, and investment-grade bonds.

The stronger correlations imply that Bitcoin has been acting as a risky asset, with a correlation coefficient spike from 0.01 between 2017 and 2019, to 0.36 for 2020–2021 “as the assets moved more in lockstep, rising together or falling together,” the institution said.

Meanwhile, the IMF also noted that Bitcoin volatility explains about one-sixth of S&P 500 volatility during the pandemic, and about one-tenth of the variation in S&P 500 returns.

A major concern for the monetary institution is the fact that a sharp decline in Bitcoin prices may add pressure to investors and lead to a fall in investments in stock markets.

The IMF also noted that spillovers from the digital asset realm into stock markets, and vice versa, are getting more common, as Bitcoin spillovers are more prominent than stablecoin ones. Furthermore, spillovers between crypto and equity markets tend to increase in episodes of financial market volatility such as the March 2020 global market crash.

„The increased and sizeable co-movement and spillovers between crypto and equity markets indicate a growing interconnectedness between the two asset classes that permits the transmission of shocks that can destabilize financial markets.“ the IMF added.

Meanwhile, IMF economist Tara Iyer stressed that “crypto assets such as Bitcoin have matured from an obscure asset class with few users to an integral part of the digital asset revolution”, adding this transition comes along with financial stability concerns.

IMF financial counselor Tobias Adrian, however, noted that the increased co-movement and overspills between crypto and equity markets have been induced by central banks and their decision to slash interest rates to near zero to support economies during the pandemic.

Bitcoin Crypto Market btc crypto market monitoring International Monetary Fund stocks bitcoin news cryptocurrency news crypto news