25 Mar 2022 Samantha McLauren

Ethereum Reaches A Monthly High; Will Its Performance Continue?

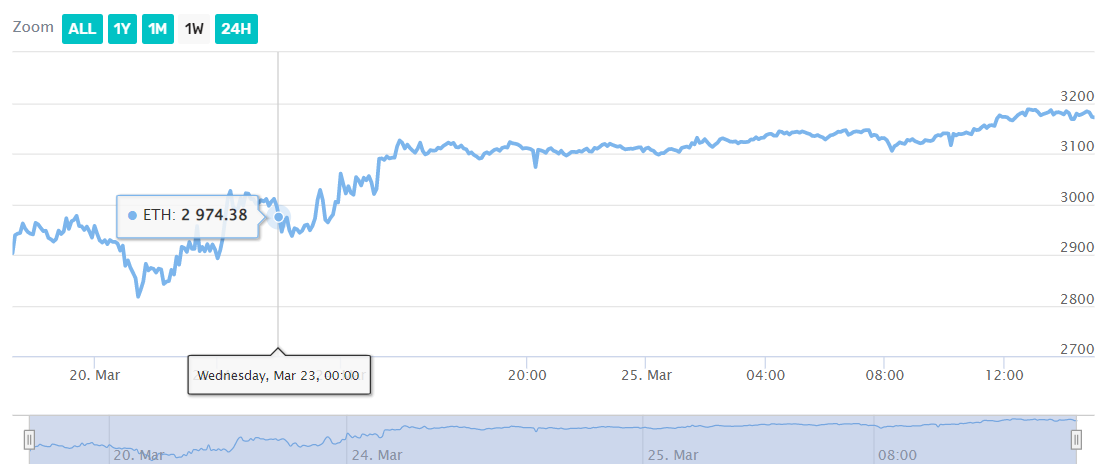

Ethereum (ETH), dubbed as the second-largest crypto to date, is seemingly moving higher and in shorter timeframes. Recently, Ethereum broke above the $3,000 mark, reaching a current price point of $3,179.06 and a 14% weekly price increase.

Source: Crypto Browser

Source: Crypto Browser

Meanwhile, the largest crypto to date, Bitcoin (BTC) is slower in its recovery, receiving only a fraction of Ethereum’s price increase. Indeed, the largest crypto to date is lagging behind in weekly price increases, reaching a value of 10.76%.

ETH 2.0 on the way?

The primary reason behind Ethereum’s recovery is the latest development in the much-anticipated transition from proof-of-work to proof-of-stake consensus mechanism, which would eliminate the need for Ethereum miners. According to the Ethereum Foundation, the “merge” is expected to be completed in the second quarter of 2022, while the last test went live last week.

The shift removes miners and replaces them with the so-called validators, which contribute, or “stake,” their cryptocurrencies.

Speaking on the subject, Eliézer Ndinga, head of research at crypto asset-management company 21Shares, noted that Ethereum’s upgrade is “very exciting” for investors.

“It has really come a long way and it’s finally getting closer to its potential success to move away from proof of work,” Ndinga added.

Furthermore, social media interest became a very important metric in understanding price behavior. It turns out that interest in the merging event has been increasing.

Technical indicators back Ethereum up

Analysts threw another view of why Ethereum’s price is climbing faster than Bitcoins, using the On-Balance-Volume (OBV), a metric used to measure price momentum.

Despite both Bitcoin and Ethereum being seen “in the green”, Ethereum’s OBV chart is suggesting a more bullish thesis for the second-largest crypto to date, as well as its potential to run higher than BTC.

Indeed, Ethereum managed to break above the OBV downtrend, which started in November 2021. The spike also suggests t the possibility of reclaiming more of its OBV and maybe making a run into the $4,000.

Bitcoin, in contrast, is still on the way to breaking its OBV trendline, which could mean slower price action until a break affirmation. Some analysts are even considering BTC to enter in a pull-back mode, which will eat away some of its gains.

Overall crypto rebound

Ethereum could also be moving up in coordination with other crypto assets, as almost all of the crypto sector is seeing positive sentiment both daily and weekly. Binance Coin (BNB), for example, is up 3% daily, which secures its price over $400 per BNB with a current price point of $420.84.

One of the biggest gainers over the past seven days, Cardano, fell into a correction mode after a nearly 40% price increase, which pushed the market cap of the project close to the now sixth-largest crypto – Ripple (XRP).

Solana (SOL), ranked at #9 is also showing massive support and its $33.5 billion in market cap is increasingly closing up on Terra (LUNA), which is eighth, with a market cap of $33.8 billion.

The rest of the crypto sector is primarily in the green with Ethereum Classic (ETC) being among the top gainers, recording an 84% weekly price increase.

Ethereum eth Ethereum news Bitcoin price bitcoin news cryptocurrency news crypto news Crypto Price Ethereum Price Ethereum 2.0